|

PRESS RELEASE FOR IMMEDIATE RELEASE: January 5, 2023

CORRECTION: The letter "A" was inadvertently left off of the sentence declaring that this is the first time Alabama has dropped into Schedule A, the lowest tax rate schedule. I apologize for any confusion.

Alabama Employers to See 54% Unemployment Insurance Tax Cut Alabama Moves Into Lowest Tax Rate Schedule

MONTGOMERY –Alabama Department of Labor Secretary Fitzgerald Washington announced that most Alabama employers will see a 54% tax cut in their 2023 unemployment insurance taxes and the state has dropped into the lowest tax rate schedule.

“Following the economic uncertainty and the record-breaking amount of unemployment compensation benefits paid out during the pandemic, it is absolutely remarkable that we have been able to lower taxes for employers and drop to the lowest tax rate schedule in this short amount of time,” said Washington.

This is the first time Alabama has dropped into Schedule, the lowest tax rate schedule, since 1997. This year’s average tax rate is also the lowest in recorded history.

Additionally, no shared costs will be incurred by employers this year, following several years of shared costs collections related to the pandemic.

The current Alabama Unemployment Tax Schedule consists of four tax rate schedules: A, B, C, and D. The original intent of the four schedules was to assist in the recovery of benefit costs so that the UI Trust Fund, from which benefits are paid, will neither become depleted nor collect excess revenue. The objective is to maintain an adequate balance so that benefits can be paid when necessary. Therefore, the balance in the trust fund determines which schedule will be in effect for the upcoming calendar year.

“Lower taxes allow businesses to hire more employees and spur spending,” continued Washington. “This record low tax rate is further evidence of Alabama’s economic recovery and shows how resilient we have been as a state.”

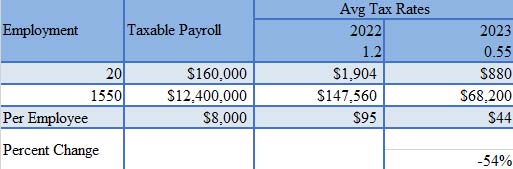

An example of unemployment insurance tax rates for an average employer below:

Business owners can now download their individual 2023 unemployment insurance tax rate notices online at www.labor.alabama.gov/eGov/login.aspx. Customers should simply login to their eGov account to see their rate.

Unemployment Insurance taxes are paid 100% by employers on the first $8,000 of wages earned per employee.

For questions regarding a business’s unemployment insurance tax rate, please call (334) 954-4741.

*Shared costs are those benefit charges which cannot be attributed to any one employer and are shared by all employers in Alabama. Bankruptcies and business closings are examples of shared costs which may be divided among employers who remain active entities.

###

Members of the media seeking more information should contact Communications Director Tara Hutchison. An Equal Opportunity Employer / Program Auxiliary aids and services available upon request to individuals with disabilities. Dial 711 for TTY Accessibility

|