|

For Immediate Release Company Net-Zero Targets to Fuel the Rapid Adoption of Zero-Emission Trucks, Says IDTechEx Thursday 15 September 2022 IDTechEx Cambridge, UK

Company Net-Zero Targets to Fuel the Rapid Adoption of Zero-Emission Trucks, Says IDTechEx

The sustainability of business operations is now a key consideration in the boardrooms of major corporations, and this is fuelling significant demand for zero-emission trucks. The eyes of the world are now open to the threat posed by climate change, with the impact of our warming climate becoming increasingly obvious through what seems ever more extreme weather events.

As governments act to dramatically reduce the emission of greenhouse gases and consumers become increasingly savvy about the environmental footprint of the products they consume, pressure is on businesses to find mechanisms to address their contribution to the climate crisis. Transitioning truck fleets from diesel combustion engines to zero-emission powertrains is a very visible way for companies to demonstrate their green credentials to their customers whilst delivering a meaningful reduction in their carbon footprint.

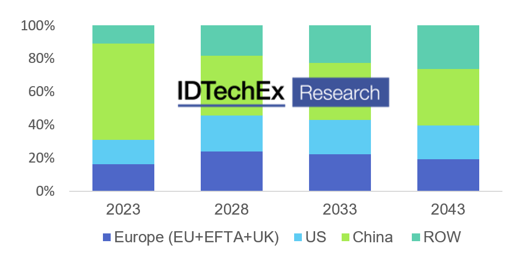

The new report from IDTechEx, “Electric and Fuel Cell Trucks 2023-2043”, provides a detailed analysis of the emerging zero-emission truck market, highlighting the significant activity of major players in the industry and the development of key technologies which are enabling the deployment of battery-electric (BEV), fuel cell (FCEV) and plug-in hybrid (PHEV) powertrains. The report contains IDTechEx’s 20-year outlook for the market, including regional forecasts for China, the U.S., and Europe. Just as electric light commercial vehicles have now become relatively commonplace in cities, IDTechEx expects zero-emission trucks, led by BEV, to become an increasingly frequent sight, with initial deployments on urban and regional routes.

IDTechEx forecasts rapid growth for the global zero-emission truck market over the next decade at a CAGR of 37.1% and expects the global medium and heavy-duty zero-emission truck market to be worth more than $200 billion per year by 2043.

Global Zero-Emission Truck (Medium and Heavy-Duty) Market Revenue Forecast: Split by Region. Source: IDTechEx - “Electric and Fuel Cell Trucks 2023-2043”

Significant Corporate Demand for Zero-Emission Trucks

Many companies who operate large truck fleets are establishing their own targets and timelines to reduce their greenhouse gas emissions, in line with national commitments to reach net-zero emissions within the next few decades. The adoption of zero-emission trucks will be critical for businesses that rely on road freight to deliver on their environmental pledges.

A coalition of companies which includes IKEA, HP, Microsoft, Nestle, and Unilever, led by the sustainability non-profit Ceres, have urged the U.S. Environmental Protection Agency to strengthen medium and heavy-duty vehicle emission standards to support fleet operators, truck manufacturers, and parts suppliers in the transition to electric vehicles.

Experience from real-world pilot testing has given many companies the confidence to place significant orders for BEV trucks, with the vehicles having proved that with today’s battery and charging technology, they can meet the daily duty requirements of shorter delivery routes. Whilst long-haul applications remain a challenge for BEV trucks, the U.S. Department of Transportation suggests that 50% of U.S. freight moves less than 100 miles per day.

OEMs Invested in Powertrain Transition

Truck manufacturers recognize that it is impossible to deliver the required future levels of exhaust emissions reduction with combustion engine fuel efficiency improvements and are making substantial investments in developing zero-emission powertrains. Leading OEMs are now moving on from initial prototype testing to building the first generation of series production models. Commitments by the OEMs themselves clearly indicate that the sector understands that the transition away from large diesel engines is happening at pace.

In a December 2020 statement from the European Automobile Manufacturers’ Association (ACEA), signed by all the CEOs of Europe’s major truck OEMs, it was acknowledged that Europe’s 2050 carbon-neutrality target means by 2040, all new commercial vehicles sold need to be fossil fuel free. The Volvo Group is targeting net-zero for its vehicles in 2040 to enable rolling fleet net-zero emissions by 2050. Similarly, Daimler Truck aims to sell only CO2-neutral vehicles in its main sales regions in North America, Europe, and Japan from 2039 forward. Scania suggests that by 2030 50% of their total vehicle sales in Europe could be electrified.

Understanding the Daily Duty Cycle of Trucks Is Key to Zero-Emission Truck Deployment

BEV powertrains cannot offer the same range or flexibility of operation on one charge as current diesel trucks, deployment, therefore, entails a greater degree of forethought. To this end, OEMs are offering consultancy services, working with customers to analyze the daily energy demanded by their operations, to then tailor the vehicle and charging infrastructure to that requirement. Modular battery solutions and a choice of electric motor sizes will help customers acquire the correct vehicle for their application. Working with customers will be vital to successful BEV truck deployment for these early-generation vehicles.

Fuel cell trucks may offer a zero-emission solution for long-haul applications. With an onboard fuel cell that generates electricity from pressurized hydrogen stored on the truck, fuel cell systems offer a greater energy density than battery electric systems and, therefore, a superior range. Using hydrogen as a fuel also offers a flexibility advantage, with refueling times comparable to diesel and far shorter than battery charging times. This has encouraged several major OEMs to invest in the technology, led by Hyundai, Toyota, and Daimler. However, the low carbon ‘green’ or ‘blue’ hydrogen required to make FCEV truly a low carbon solution is currently both extremely scarce and expensive. The cheap ‘grey’ hydrogen used today, produced from natural gas, is effectively a fossil fuel in a different guise. The viability of fuel cell truck operations depends on huge government-level investment in low carbon hydrogen generation, the establishment of hydrogen distribution networks, and the widespread buildout of hydrogen refueling infrastructure. The longer it takes for this to be realized, the further BEV powertrains will progress, with significant scope for improvements in battery energy density, powertrain efficiency, and fast charging, alongside cost reductions. Fuel cell truck development is chasing a moving target.

To find out more, the IDTechEx report “Electric and Fuel Cell Trucks 2023-2043” is designed to help businesses plan for the future in this dynamic market. The report contains 80 forecast lines, giving a twenty-year outlook for zero-emission truck sales, market penetration, battery demand, fuel cell demand and market value, with separate forecasts for medium and heavy-duty trucks. See www.IDTechEx.com/etrucks for more information.

This report is part of IDTechEx’s broader mobility research portfolio, tracking the adoption of electric vehicles, battery and technology trends across land, sea, and air. Find out more, including downloadable sample pages, at www.IDTechEx.com/research/EV.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com. Images download: https://www.dropbox.com/sh/x9fx54ijjcx9l5v/AAAQGShWFByEzY7meExdihnUa?dl=0 Media Contact: Natalie Fifield Digital Marketing Manager press@IDTechEx.com +44(0)1223 812300 Social Media Links: Twitter: https://www.twitter.com/IDTechEx LinkedIn: https://www.linkedin.com/company/idtechex/ Facebook: https://www.facebook.com/IDTechExResearch

|