|

Electric vehicle performance is fundamentally tied to EV batteries, at cell- and pack-level. As new EV sectors are unlocked and performance targets are reached, trends in material demand across cell and pack components emerge. This new release by market intelligence firm IDTechEx explains the material trends in EV cathodes, anodes and packs that underscore the EV market as a whole. IDTechEx are continually tracking the EV, battery and advanced materials innovation space and our experts are available to offer further insights and data to support your reporting around these areas. You can speak to our team at press@IDTechEx.com for more. --- For Immediate Release Material Demand for EV Batteries to Reach 22.2 Million Tonnes by 2036 Wednesday 18th February 2026 IDTechEx Cambridge, UK Material Demand for EV Batteries to Reach 22.2 Million Tonnes by 2036 Author: Daniel Parr, Technology Analyst at IDTechEx As electric vehicle sales continue to increase, demand for electric vehicle battery materials grows with it. However, as pack and cell designs evolve, material demand trends emerge across many components. Minimizing cost and maximizing range, through improvements to energy density, are the primary considerations for battery pack developers, across many sectors, but the method for achieving these targets will shift as new cell chemistries and material innovations come online. Opportunities can be found across the materials space for EV battery packs and cells. Primary focuses are on cathode and anode materials, however light-weighting of pack enclosure materials is also an area of increasing interest. IDTechEx's new market report "Materials for Electric Vehicle Battery Cells and Packs 2026-2036: Technologies, Markets, Forecasts" illustrates these trends in detail, with overall material demand expected to reach 22.2 million tonnes by 2036. Overview of application markets The EV market is dominated by battery electric cars (BEV cars). However, there is significant opportunity in other EV sectors, including buses, trucks, light commercial vehicles and micro-EVs. Differentiation of cell and pack materials is expected across different vehicle sectors depending on specific application needs, e.g. power density, energy density, lifetime and cost. The EV market is dominated by three regional segments: China, Europe and North America. Currently, China is the largest of the three with more than 50% of new car sales in 2024 being electric. However, European and North American markets are expected to catch up over the forecast period. Chemistry trends vary from region to region. For example, LFP is dominant in China due to low costs, while NMC and NCA are more common in Europe and North America due to higher performance. However, it is expected that LFP will become more common in Europe and North America in the short and medium term. Battery cell materials Cell materials make up more than 70% of material demand for EV battery packs. Cell material demand is highly dependent on chemistry trends, especially on the anode and cathode side. IDTechEx predicts a general shift towards LFP over NMC over the forecast period, due to lower costs per kWh, while the NMC share (especially prevalent in high-power applications and luxury cars) will shift towards higher nickel content, due to higher performance and energy density and increasing cobalt prices. On the anode side, the rise of silicon will correspond with slower growth for graphite. This rise is connected to usage of higher percentage silicon in silicon additive anodes and commercialization of mid- (20-40%wt) and high-silicon (80-90%) anodes for high performance applications towards the end of the forecast period. Raw materials prices are often volatile. For example, inflation of lithium prices in 2022 and 2023 led to significantly increased battery prices and resulted from short-term undersupply of lithium compared to demand from electric vehicles. Cobalt prices are also volatile and have spiked significantly in 2025, which may accelerate the adoption of higher-nickel NMC.

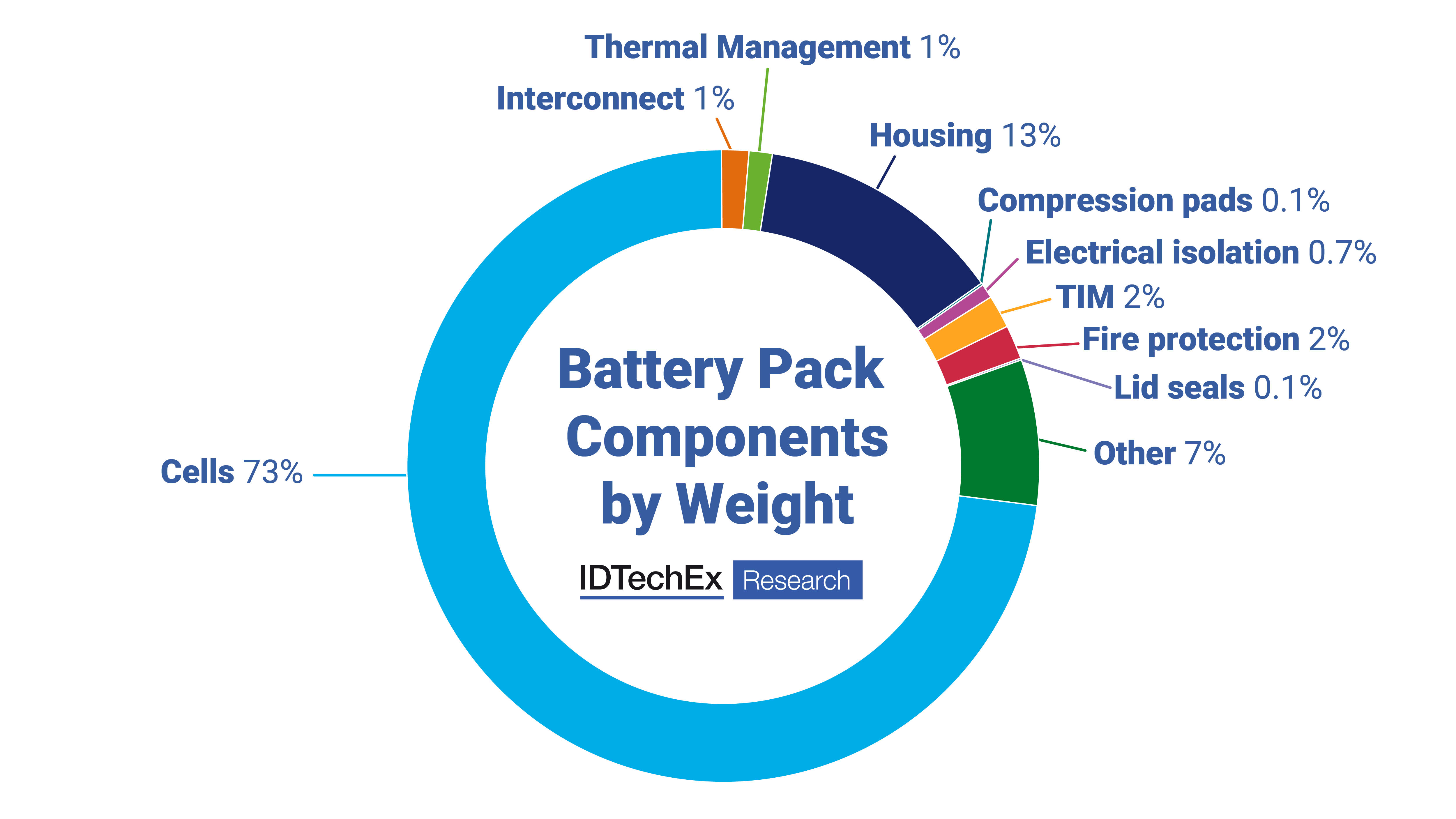

Battery pack components by weight. Source: IDTechEx Pack materials On the battery pack side, a general trend is towards reducing material demand to increase pack energy density. This includes potential lightweighting of major components such as the battery pack enclosure. Aluminium and steel are the incumbent technologies for battery pack enclosures, however composite materials such as glass-fiber reinforced polymer (GFRP) and carbon fiber reinforced polymer (CFRP) are beginning to see adoption due to their lower weight. In the new market report, "Materials for Electric Vehicle Battery Cells and Packs 2026-2036: Technologies, Markets, Forecasts", IDTechEx provides analysis of EV battery material demand, including: Market forecasts and analysis - Granular 10-year forecast of material demand from electric vehicle battery cells and packs by material (kt demand, US$B) and application (kt demand). A forecast for cathode market share by GWh up to 2036 is also included.

- Analysis of market shares for EV battery cell suppliers across the three primary regions (by GWh).

- Discussion of regulations across the three primary regions and their role in EV adoption and materials trends.

Technology trends - Qualitative and quantitative predictions regarding changes in material trends for battery cell and pack materials, including anodes, cathodes, enclosures, fire protection materials, thermal management materials and more.

- Benchmarking of cell chemistries (anodes and cathodes) is also included.

- Evaluation of cell-to-pack ratios and their effect on energy density as well as the potential for cell-to-body and cell-to-chassis.

- Evaluation of light-weighting potential for battery pack enclosures, in the form of polymer composite materials

Cost analysis: - Estimations of LFP, NMC 811 and NMC 532 material costs in 2025 as well as predictions of future cell costs up to 2036.

- Discussion of the effect of price volatility for critical battery materials such as lithium, cobalt and nickel, is also included, as well as global material extraction volumes up to 2036 for these three materials.

For more information on this report, including downloadable sample pages, please visit www.IDTechEx.com/EVBattMat, or for the full portfolio of related research available from IDTechEx, see www.IDTechEx.com. About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com. Media Contact:

Charlotte Martin

Subscriptions Marketing Manager press@IDTechEx.com

+44(0)1223 812300

Social Media Links:

X: https://www.twitter.com/IDTechEx

LinkedIn: https://www.linkedin.com/company/idtechex/

|