|

|

|

|

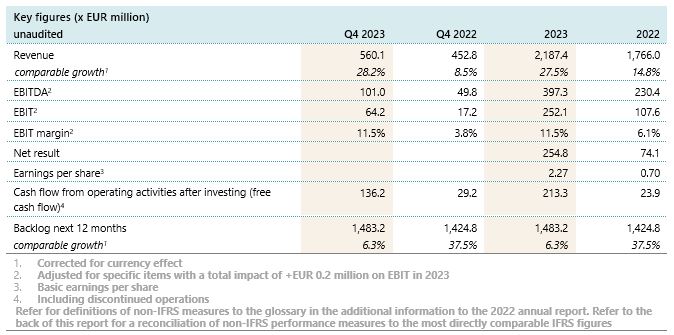

Strong 2023 for Fugro High growth, improved margins and boosted cash flow - 27.5% revenue growth to EUR 2.2 billion driven by high client demand in energy markets

- Significant step-up in performance in all regions, resulting in EBITDA of EUR 397.3 million (18.2% margin) and EBIT of EUR 252.1 million (11.5% margin)

- Net result increases to EUR 254.8 million compared to EUR 74.1 million in 2022

- Boosted cash flow of EUR 213.3 million compared to EUR 23.9 million last year as a result of higher operating cash flow and strict working capital management

- Robust 12-month backlog of EUR 1.48 billion; 6.3% increase after steep growth during previous quarters

- Proposed dividend of EUR 0.40 per share

- New strategy Towards Full Potential and mid-targets for 2027 launched in November 2023

- Outlook 2024: continued revenue growth and EBIT margin within mid-term target range of 11-15%.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Heine, CEO: “I am excited to announce another quarter of strong performance, concluding a year in which we made great progress in delivering on our strategy, resulting in an EBIT margin of 11.5%. By benefitting from significant investments in energy systems around the world, including offshore wind, we have realised a major step-up in our results. Better contracting conditions, substantially higher activity levels and good project execution resulted in a step change in profitability, in particular in our marine site characterisation activities. We delivered on our Path to Profitable Growth targets, and we also made good progress with our non-financial targets by improving employee engagement and reducing our vessels’ carbon emissions. I am also pleased that our clean balance sheet and robust cash flow generation enable us to resume dividend payments.

Over the past years, we have created a solid foundation to seize the compelling opportunities in our markets, resulting from an ever-increasing need for Geo-data insights. With our unique client solutions, highly skilled people, market-agnostic assets and innovative scalable technology we are ready for the next chapter of our strategic journey: Towards Full Potential. Our key strategic priority is to grow and transform our current business, which will continue to be the most important driver of our revenue and value creation in the mid term. In addition, we have defined two other priorities that offer significant potential for the long term: expanding into developing segments with a large requirement for Geo-data such as coastal resilience, and building recurring revenues with Geo-data as a service. We have set targets for 2027 for our financial, social and environmental performance. In order to deliver on our ambitions while ensuring sustainable growth, we remain committed to investing in our people, technology and execution excellence.

The macro-economic and geopolitical environment remains uncertain and we continue to navigate this carefully. At the same time, Fugro remains well positioned to benefit from of the energy transition, massive infrastructure investments and urgently needed climate change adaptation.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

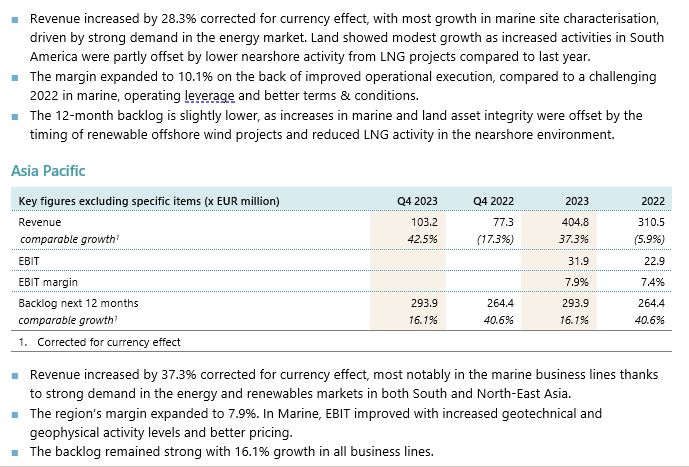

Fourth quarter Revenue in the fourth quarter increased by 28.2% on a currency comparable basis, in line with the growth during the previous quarters. At 11.5%, the EBIT margin was remarkably strong for a typically low season, as a result of strong project execution in marine and improved terms & conditions.

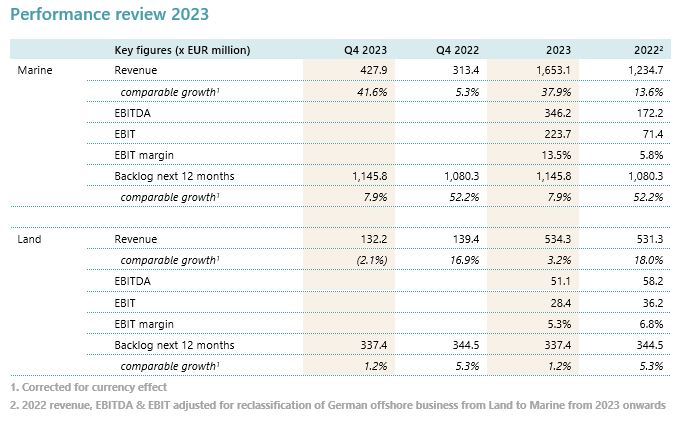

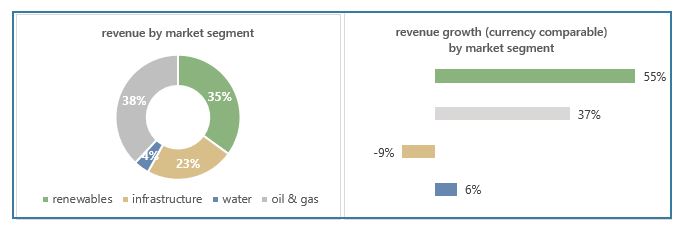

Full-year For the full year, we realised 27.5% revenue growth on a currency comparable basis by successfully capturing high client demand in the offshore wind (+55%), and oil & gas (+37%) markets. Marine increased by 37.9% while the utilisation of Fugro’s owned and long-term chartered fleet amounted to 75% compared to 72% last year. In Land, growth was limited to 3.2% as a result of subdued revenues in the infrastructure market (-9%) in some key geographies and business rationalisations in 2022 (France, Russia).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

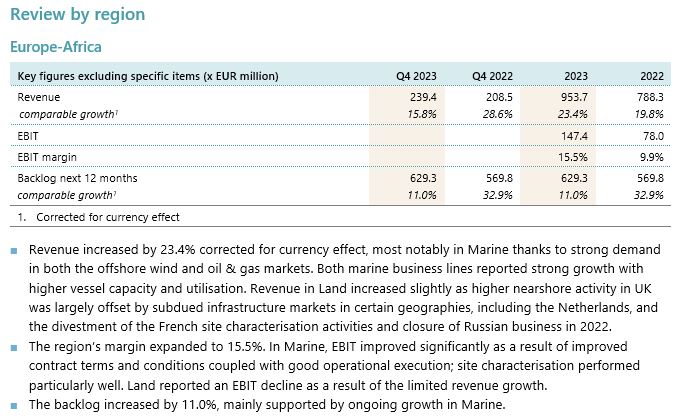

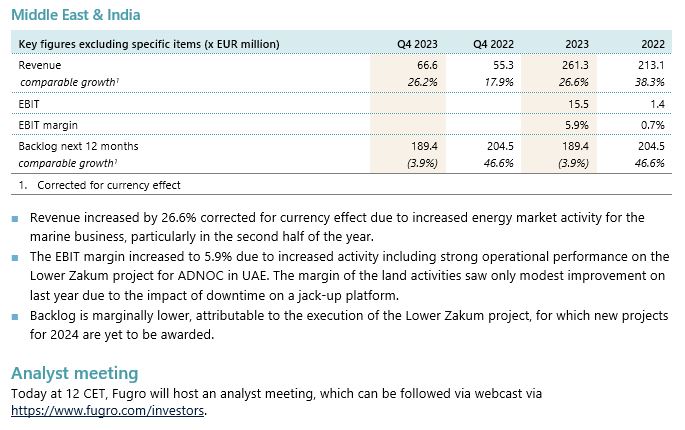

The group’s EBIT margin improved to 11.5%; all regions reported higher results as a result of top line growth in combination with operational efficiencies. In marine, both site characteration and asset integrity business lines reported strongly improved margins; in particular site characterisation performance in Europe-Africa was exceptional. Land reported a lower margin due to limited revenue growth and downtime on a jack-up platform in the Middle East in the first half year.

Operating cash flow before changes in working capital increased by EUR 167.9 million to EUR 347.3 million. Working capital decreased to 8.9% of revenue; an exceptionally low number of days of revenue outstanding of 75 at year-end resulted in a significant unwind of working capital in the fourth quarter. Capital expenditure amounted to EUR 182.0 million, below our guidance of EUR 200 million, excluding the impact of the unwind of the sale and lease back arrangement of the Fugro Scout and Fugro Voyager vessels.

Net debt declined to EUR 110.5 million from EUR 207.4 million in December 2022. At year-end, net leverage amounted to 0.3x.

Subject to approval by the annual general meeting of shareholders on 25 April 2024, a dividend of EUR 0.40 per share will be paid over the full-year 2023 in cash. As announced at the third quarter trading update, Fugro has amended its dividend policy to 25-45% of net result.

Outlook 2024

In line with the new strategy Towards Full Potential and related mid-term guidance, Fugro expects: - Continued revenue growth, primarily driven by the energy markets

- EBIT margin within mid-term target range of 11-15%

- Ongoing investments in assets, technology, people and execution excellence

- Capex of around EUR 250 million.

Recent project awards

- Europe-Africa region: a 10-year framework agreement with Dutch network operator Gasunie for environmental management services in relation to the development of future proof energy infrastructure; mapping of the coastal habitats of the entire Italian coast as part of the Italian government’s Marine Ecosystem Restoration Project; geotechnical and geophysical surveys for Lithuania’s first offshore wind farm with Ignitis Renewables; a geophysical survey for Doordewind offshore wind farm zone; nearshore investigation for RWE Awel y Môr in Wales; metocean floating lidar surveys for ACCIONA Energía in Italy.

- Americas region: an offshore wind project with Attentive Energy in NY (US East Coast) for wind, metocean and environmental monitoring; airborne lidar mapping over Puerto Rico and the US Virgin Islands for the US Geological Survey’s 3D Elevation Programme; a hydrographic survey in the Seychelles to update nautical charting under contract to the UK Hydrographic Office; and a 5-year contract for road condition assessment and asset monitoring services from Harris County, Texas, the third largest county in the US.

- Asia Pacific region: a combined geotechnical and geophysical site characterisation of a gas development in Indonesia; a geophysical survey with a deepwater autonomous underwater vessel offshore Malaysia; deployment of three LiDAR buoys to support wind resource and early metocean characterisation in the coastal waters of South Korea; and a two-year agreement to provide geotechnical consultancy in Hong Kong to support the infrastructure market.

- Middle East & India region: offshore geophysical and geotechnical services for Saudi Aramco’s Zuluf and Qatif fields; geotechnical site investigations for NEOM’s Trojena infrastructure development; asset integrity operations for McDermott for the North Field Production Sustainability project offshore Qatar; and a pilot project for Saudi Aramco at Tanajib with uncrewed surface vessel Fugro Pegasus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

About Fugro Fugro is the world’s leading Geo-data specialist, collecting and analysing comprehensive information about the Earth and the structures built upon it. Adopting an integrated approach that incorporates acquisition and analysis of Geo-data and related advice, Fugro provides solutions. With expertise in site characterisation and asset integrity, clients are supported in the safe, sustainable and efficient design, construction and operation of their assets throughout the full life cycle.

Employing approximately 11000 talented people in 55 countries, Fugro serves clients around the globe, predominantly in the energy, infrastructure and water industries, both offshore and onshore. In 2023, revenue amounted to EUR 2.2 billion. Fugro is listed on Euronext Amsterdam.

This release contains information that qualifies, or may qualify as inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation. It may contain forward-looking statements which are not historical facts, including (but not limited to) statements expressing or implying Fugro's beliefs, expectations, intentions, forecasts, estimates or predictions (and the assumptions underlying them). These statements necessarily involve risks and uncertainties. Actual future results and situations may differ materially from those expressed or implied in any forward-looking statements. This may be caused by various factors (including, but not limited to, developments in the energy and related markets, currency risks and unexpected operational setbacks). Any forward-looking statements in this announcement are based on information currently available to management. Fugro assumes no obligation to in each case make a public announcement if there are changes in that information or if there are otherwise developments in respect of the forward-looking statements in this announcement.

Note to Editors: The release can be found at https://www.fugro.com/news/press-releases/2024/full-year-results-2023 and is attached.

Caption: CPT beach survey

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Judith Patten JPPR 18 Prior Park Buildings Bath BA2 4NP United Kingdom

For all inquiries, please contact us at: judithpatten@jppr.uk.com

If you would like to opt out of future emails, please unsubscribe

|

|

|

|

|

|